ASIC miners play a central role in modern Bitcoin mining, especially as network difficulty and competition continue to rise. Designed for a single purpose, ASIC mining machines focus on delivering high performance and efficiency, making them the preferred choice for professional and long term mining operations.

Understanding the profitability and value of ASIC miners is essential before making any investment decision. Factors such as power efficiency, electricity costs, mining difficulty, and operational scale directly influence whether an ASIC miner is the right solution for your mining goals.

What Is an ASIC Miner?

An ASIC miner (Application-Specific Integrated Circuit miner) is a specialized machine built exclusively to mine a specific cryptocurrency or algorithm, such as Bitcoin’s SHA-256. Unlike GPUs or CPUs, ASIC miners are engineered for one task only, allowing them to achieve significantly higher hash rates and better energy efficiency.

Because of this specialization, ASIC miners dominate Bitcoin mining today. They are commonly used in professional mining facilities, data centers, and mining containers where performance, stability, and long term operation are priorities.

How Much Does an ASIC Miner Make?

The amount an ASIC miner can generate depends on several variables, making profitability highly dynamic rather than fixed. Key factors include the miner’s hash rate, power consumption, electricity cost, network difficulty, and current Bitcoin price.

ASIC miner profitability is typically higher for machines with strong efficiency (low J/TH) and access to low electricity rates. While some ASIC miners can generate consistent daily rewards through mining pools, profitability can fluctuate over time due to changes in market conditions and mining difficulty.

Simple ASIC Miner Profitability Calculator (Estimated)

You can estimate ASIC miner profitability using the following basic formula:

Daily Revenue = (Your Hashrate / Network Hashrate) × Daily Block Rewards

Daily Profitability = Daily Revenue − Electricity Cost

Where:

- Hashrate = your miner’s TH/s

- Electricity Cost = (Power Consumption in kW × Electricity Price × 24 hours)

This calculation provides an estimate and should always be used as a reference rather than a guarantee, as mining conditions constantly change.

ASIC Miners in Comparison With Solo Miners

ASIC miners and solo mining are often confused, but they represent two different aspects of Bitcoin mining. An ASIC miner refers to the type of hardware used for mining, while solo mining describes a mining method or strategy. In other words, solo mining does not define the machine itself, but rather how the mining process is carried out using that machine.

An ASIC miner can be used either in a mining pool or for solo mining, depending on the miner’s strategy and available hash power. Solo mining involves operating mining hardware independently in an attempt to solve blocks and receive the full block reward, whereas pool mining distributes rewards among multiple miners based on contributed hash power. Understanding this distinction is essential when evaluating mining options and choosing the right setup for long term Bitcoin mining.

Key Differences

ASIC Miner

An ASIC miner is a specific, powerful machine designed only for mining a particular cryptocurrency, such as Bitcoin. It offers high hash rates, optimized efficiency, and is commonly used in professional or large scale mining operations.

Solo Mining

Solo mining is an individual mining approach where a single miner uses their own hardware (often an ASIC miner) to independently solve cryptographic puzzles and attempt to claim the entire block reward. While the reward can be high, the chances of success are low without significant hash power.

In practice, most ASIC miners participate in mining pools rather than solo mining, as pools provide more consistent and predictable rewards.

Are ASIC Miners Worth It?

Yes, ASIC miners can be worth, but only when they are aligned with the miner’s goals, operating environment, and cost structure. These machines are designed to deliver high performance and efficiency, making them suitable for users who plan to mine Bitcoin consistently rather than casually.

The value of an ASIC miner depends largely on electricity pricing, hardware efficiency, and long term planning. For users with access to stable power, proper cooling, and a clear mining strategy, ASIC miners can offer better performance and reliability compared to general purpose hardware. However, for beginners or users without suitable infrastructure, smaller home or entry level mining solutions may be a more practical starting point.

ASIC miners remain the backbone of Bitcoin mining in 2026. Understanding how they work, how profitability is calculated, and how they compare to other mining approaches is essential for making informed decisions and building a sustainable mining strategy.

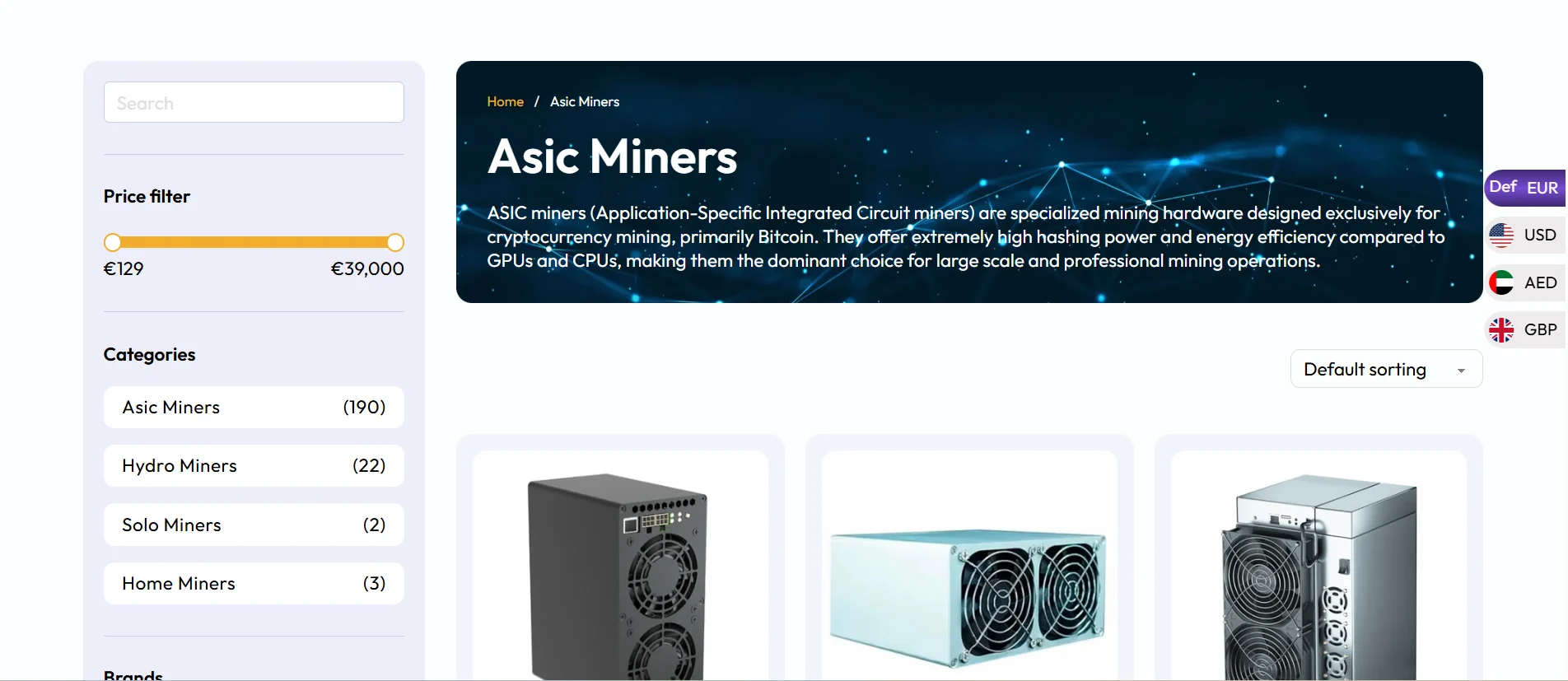

Where Can I Find ASIC Miners?

At shop.bitmernmining.com we offer a wide range of ASIC miners suitable for different experience levels and operational needs. From professional grade mining hardware to efficient ASIC solutions, users can explore available options and select miners that match their infrastructure, budget, and long term plans.

You can check all the avaliable Asic Miners direct on this page here!

If you are interested in ASIC mining but are unsure which option is best for you, we recommend reading our complete guide: 👉 10 Best Bitcoin Mining Machines for 2026 | Performance & Efficiency This guide helps compare different mining machines and highlights which miners are suitable for home users, professionals, and large scale operations.

Frequently Asked Questions About ASIC Miners

Are ASIC miners profitable?

ASIC miners can be profitable depending on several factors, including hardware efficiency, electricity cost, network difficulty, and Bitcoin price. Miners with low power consumption per terahash (J/TH) tend to perform better over time, especially when electricity rates are competitive. Profitability is not fixed and can change as market conditions and mining difficulty evolve.

Are ASIC miners loud?

Yes, most ASIC miners are loud due to high-speed cooling fans required to manage heat during continuous operation. Noise levels typically make them unsuitable for residential environments unless additional soundproofing or alternative cooling solutions, such as hydro cooling, are used. Home and hydro-cooled mining setups are generally quieter than industrial air cooled ASIC miners.

What is an ASIC vs GPU miner?

An ASIC miner is a specialized machine designed to mine a specific cryptocurrency or algorithm, such as Bitcoin’s SHA-256, offering significantly higher efficiency and hash rate. A GPU miner uses graphics cards that can mine multiple cryptocurrencies but with lower efficiency for Bitcoin. ASIC miners dominate Bitcoin mining, while GPUs are more commonly used for flexible or experimental mining purposes.

Can I mine Bitcoin alone with one ASIC miner?

It is technically possible to mine Bitcoin alone with a single ASIC miner, but the chances of successfully finding a block are very low due to high network difficulty. Most individual miners join mining pools to receive more consistent rewards. Solo mining is generally only practical for users with substantial hash power or those mining for experimentation rather than predictable returns.

Stay up to date with the latest mining news, new hardware arrivals, and restocks of the miners you care about at Bitmern Mining Shop. Subscribe to our newsletter today and never miss important updates, product launches, or availability announcements.